Why High-Conviction Investing Is Outperforming Diversification

Broad diversification once signalled prudence. Today, it may signal drift. Research increasingly suggests that highly diversified equity portfolios dilute performance rather than protect it, while the strongest outcomes are coming from conviction—not coverage.

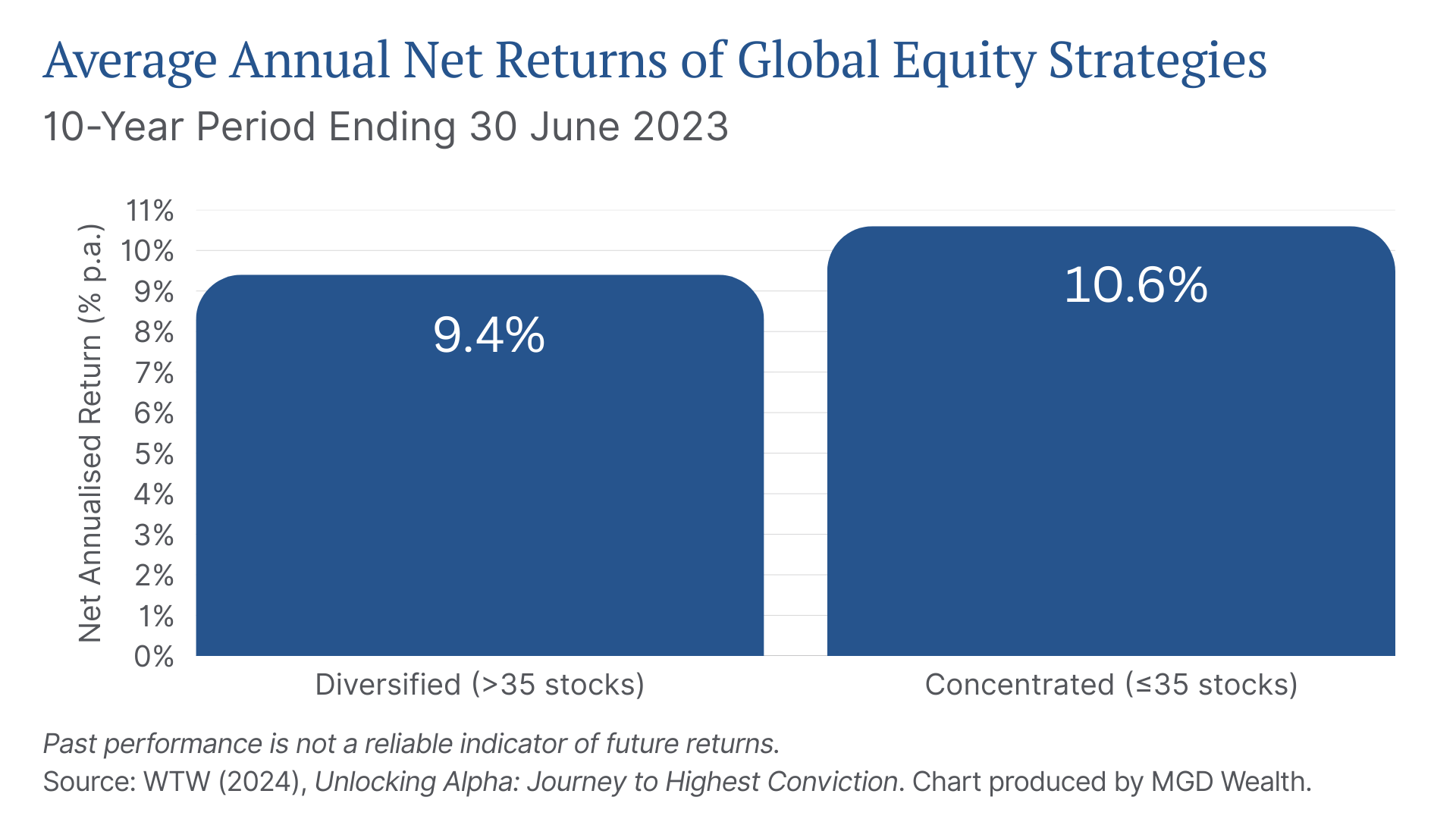

A decade of research by our global research partner WTW has shown that high-conviction equity strategies—those with fewer, more targeted positions—have consistently outperformed more widely diversified portfolios.¹,²

MGD Wealth works closely with WTW to translate these insights into client strategies that favour depth over breadth and support long-term discipline. The approach prioritises quality over quantity, constructs portfolios with intention, maintains resilience through volatility and has consistently outperformed more conventional, broadly diversified approaches over the long term.¹,²,³

Key Takeaways

Diversification is not the same as protection: When portfolios hold hundreds of stocks, they often end up tracking the market while still charging active fees.¹

Focus has delivered a measurable edge: Over the decade to 30 June 2023, strategies with 35 or fewer holdings outperformed diversified peers by 1.2% p.a. (net of fees).²

What really drives results: Managers who back their best ideas—and accept short-term deviation from the index—are more likely to generate long-term excess returns.²,³

Market context matters: With markets heavily concentrated in a few mega-cap names, disciplined portfolio construction is increasingly important.¹,⁵

Market context matters. With leadership concentrated in a few large companies, thoughtful portfolio construction is increasingly important.¹,⁵

Rethinking Diversification

Traditional active equity funds often hold hundreds of stocks. While this appears to offer protection, it can leave investors with portfolios that closely mimic the market—while still charging active management fees. WTW’s research across more than 500 global equity strategies shows that portfolios with 35 or fewer holdings consistently outperform broader peers. Over the 10 years to 30 June 2023, these concentrated strategies outperformed more diversified ones by 1.2% per annum (net of fees)—driven not by market timing, but by repeatable stock selection skill.¹,²,³

+1.2% p.a.

Over a 10-year period to 30 June 2023, global equity strategies with 35 or fewer holdings outperformed more diversified portfolios by 1.2% per annum, net of fees, according to research by WTW.

The Role of Active Share

Much of this performance edge comes from high active share—a measure of how different a portfolio is from its benchmark. High-conviction managers typically score well on this metric, as they allocate capital to only their best ideas and avoid over-diversifying for its own sake. This matters because, as research has shown, investors are often paying active fees for portfolios that behave more like passive products.²,³

Discipline Over Diversion

The most effective investment strategies are built on process, not prediction. At MGD Wealth, we seek managers who follow a consistent, research-driven approach grounded in company fundamentals—not short-term macro forecasts or sentiment. Through our partnership with WTW, we gain access to institutional-grade managers typically unavailable to retail investors.

One example is the WTW Global Equity Focus Fund (TWIM GEFF), which consolidates the top 10–20 stock ideas from a curated group of high-conviction managers into a single strategy. This approach offers differentiated insights, high active share, and clear alignment with a long-term investment philosophy.⁴

Proven in Practice

As a live example of this approach in practice, WTW has implemented a high-conviction, multi-manager equity strategy for a large charitable foundation since 2010. By allocating capital only to managers’ best ideas and removing index-driven constraints, the foundation achieved net outperformance of +1.5% per annum from inception to 2023, demonstrating how conviction-based design can translate into sustained results.³

These portfolios aren’t built for mass distribution. They require intentional design, manager alignment, and a governance structure capable of supporting a differentiated strategy. Through our relationship with WTW, MGD Wealth clients can access these institutional-grade capabilities.³

Why This Matters Now

With market leadership increasingly concentrated in a handful of large-cap stocks and macroeconomic conditions remaining uncertain, investors need a framework that aligns capital with insight.¹,⁵

High-conviction investing brings clarity to complexity. It directs capital towards fundamentals rather than noise. And as with any disciplined practice, success often depends not on doing more, but on doing what matters—with focus, discipline, and intention.

For any questions or to discuss your portfolio, reach out to your MGD Wealth advisory team.

Important Note: Please note that past performance is not an indication of future performance. Any advice included in this article is general and has been prepared without taking into account your objectives, financial situation or needs. As such, you should consider its appropriateness having regard to these factors before acting on it. Before you make any decision about whether to acquire a certain financial product, you should obtain and read the relevant product disclosure statement.

References

1. WTW, Equity investments: Our answer to market concentration, October 2024.

2. WTW, Unlocking Alpha: Concentrated portfolios outperform, March 2024.

3. WTW, Unlocking Alpha: Journey to Highest Conviction, 2024.

4. WTW, TWIM Global Equity Focus Fund, April 2025.

5. Stuart Gray, WTW, How to strike a balance between concentration and diversification, September 2024.