Getting Advisory Boards Right for Your Business

In today’s business landscape—marked by increasing competition, regulatory shifts, and technological advancements—business owners face increasingly complex decisions.

Many are turning to advisory boards not just for guidance but as a structured mechanism for sharper decision-making, risk mitigation, and long-term success.

According to the 2023-2025 State of the Market Report by the Advisory Board Centre, 90% of businesses report a positive impact from their advisory board, citing improved decision-making, risk management, and strategic execution. Yet, many business owners hesitate to establish an advisory board, uncertain about how to structure and leverage it for real results.

At MGD Wealth, we work with business owners of $20M+ turnover across industries such as agriculture, construction, professional services, and manufacturing. A well-structured advisory board provides these leaders with independent expertise, strategic clarity, and the ability to anticipate challenges before they arise. By curating high-calibre advisory boards, we help businesses refine decision-making, seize opportunities, and drive sustained success.

According to the 2023-2025 State of the Market Report by the Advisory Board Centre, 90% of businesses report a positive impact from their advisory board, citing improved decision-making, risk management, and strategic execution.

Understanding the role of advisory boards and when you need one

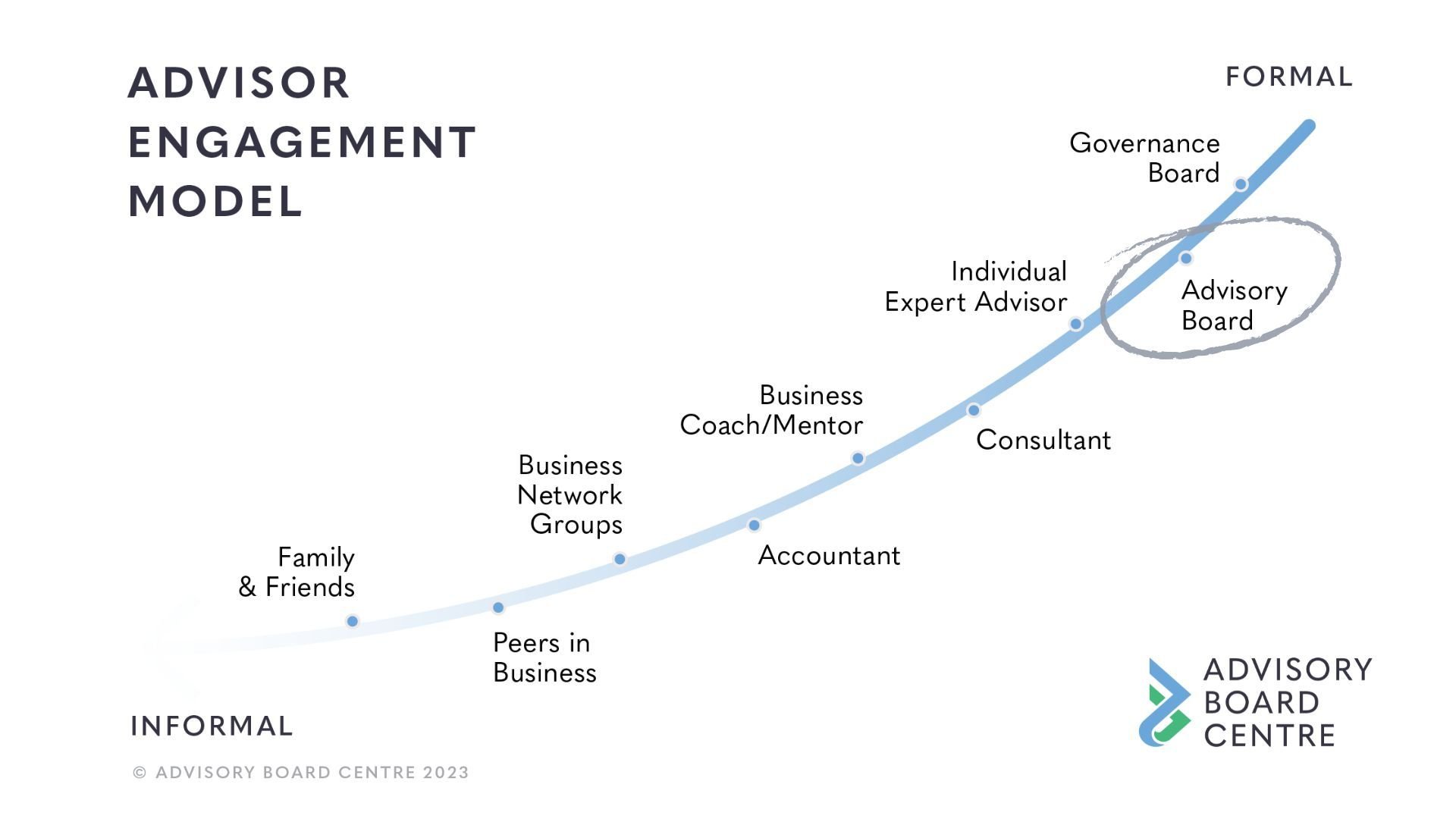

Advisory boards exist along a spectrum—from informal networks to highly structured governance boards. The following model illustrates how they evolve based on the business’s level of complexity and needs:

Reference: Advisory Board Centre

Regardless of structure, a high-impact advisory board is a problem-solving model, not just a discussion forum. Unlike governance boards, an advisory board does not take control; instead, it enhances leadership decision-making by providing independent insights and strategic direction.

Many business owners assume advisory boards are only for large enterprises, but the 2023-2025 State of the Market Report highlights that advisory boards provide measurable benefits across multiple industries.¹ The report found that 90% of businesses engaging advisory boards reported improvements in decision-making clarity, risk mitigation, and strategic execution.

A well-structured advisory board delivers impact only when it is purposefully designed. At MGD Wealth, we apply a Best Practice Framework built around five key principles:

Structure & Discipline: Ensuring clarity, efficiency, and accountability.

Clarity of Scope: Aligning board efforts with specific business objectives.

Independence: Bringing fresh perspectives and unbiased advice.

Measurement: Tracking tangible business outcomes.

Fit for Purpose: Customising the board to meet evolving business needs.

Principle #1: Structure & Discipline

(turning strategy into execution)

A well-run advisory board introduces structured decision-making that turns discussions into action. The 2023-2025 State of the Market Report found that businesses engaging advisory boards for structured oversight and accountability experienced measurable improvements in operational efficiencies and financial performance.¹

A skilled, independent chair ensures:

Strategic conversations remain focused.

Objectives are clearly defined and tracked.

Board recommendations translate into measurable business improvements.

Principle #2: Clarity of Scope

(defining the board’s purpose)

Too often, advisory boards are formed with broad mandates like ‘growth’ or ‘innovation,’ leading to ineffective discussions. The most effective boards focus on specific, high-impact objectives.

The 2023-2025 State of the Market Report highlights that businesses leveraging advisory boards for defined strategic objectives rather than broad mandates saw higher effectiveness and greater long-term impact.¹ Boards with a clear scope—such as succession planning, risk mitigation, or market expansion—delivered more actionable insights than those operating with vague goals.

Principle #3: Independence

(the power of an external perspective)

One of the greatest strengths of an advisory board is its independent perspective—which challenges internal biases, identifies risks, and sharpens strategic direction.

According to the 2023-2025 State of the Market Report, advisory boards are critical in mitigating risks during business transitions.¹ Businesses that leveraged advisory boards for expansion planning and regulatory oversight reported fewer operational disruptions and improved market adaptation strategies.

An effective advisory board:

Brings deep expertise beyond internal leadership.

Challenges conventional thinking.

Maintains independence to serve the business’s best interests.

Principle #4: Measurement

(ensuring ROI from your advisory board)

A well-structured advisory board should be continuously evaluated. Research shows that businesses with high-functioning advisory boards report increased confidence and resilience during economic shifts.¹

Key indicators of success:

Is the board driving strategic priorities?

Has decision-making improved?

Are insights translating into financial gains?

Is the board delivering measurable business impact?

Principle #5: Fit for Purpose

(structuring an advisory board for business needs)

An advisory board should be tailored to the business’s evolving priorities—whether for growth, succession, governance, or transition planning.

The 2023-2025 State of the Market Report found that businesses in highly regulated industries benefited from advisory boards composed of sector-specific experts, ensuring compliance while driving strategic growth.¹ Additionally, businesses that structured their advisory boards around performance measurement and clear governance models reported greater long-term success in executing strategic plans.

The following framework illustrates how businesses can move from informal advisory input to a best-practice structured board:

Reference: Advisory Board Centre

By carefully designing the board’s composition, meeting cadence, and scope, business owners can ensure their advisory board remains a dynamic, results-driven asset.

References

¹ 2023-2025 State of the Market Report by the Advisory Board Centre

At MGD Wealth, we partner with business leaders to create high-functioning advisory boards that deliver measurable value. If you are reassessing your advisory board’s effectiveness, we welcome a conversation about how to refine and elevate its impact.

Important Note: Any advice included in this article is general and has been prepared without taking into account your objectives, financial situation or needs. As such, you should consider its appropriateness having regard to these factors before acting on it. Before you make any decision about whether to acquire a certain financial product, you should obtain and read the relevant product disclosure statement.